🔥Fire

3rd Element

Can be heard, felt, and seen

Elementally, Fire is associated with life, passion, energy, and transformation.

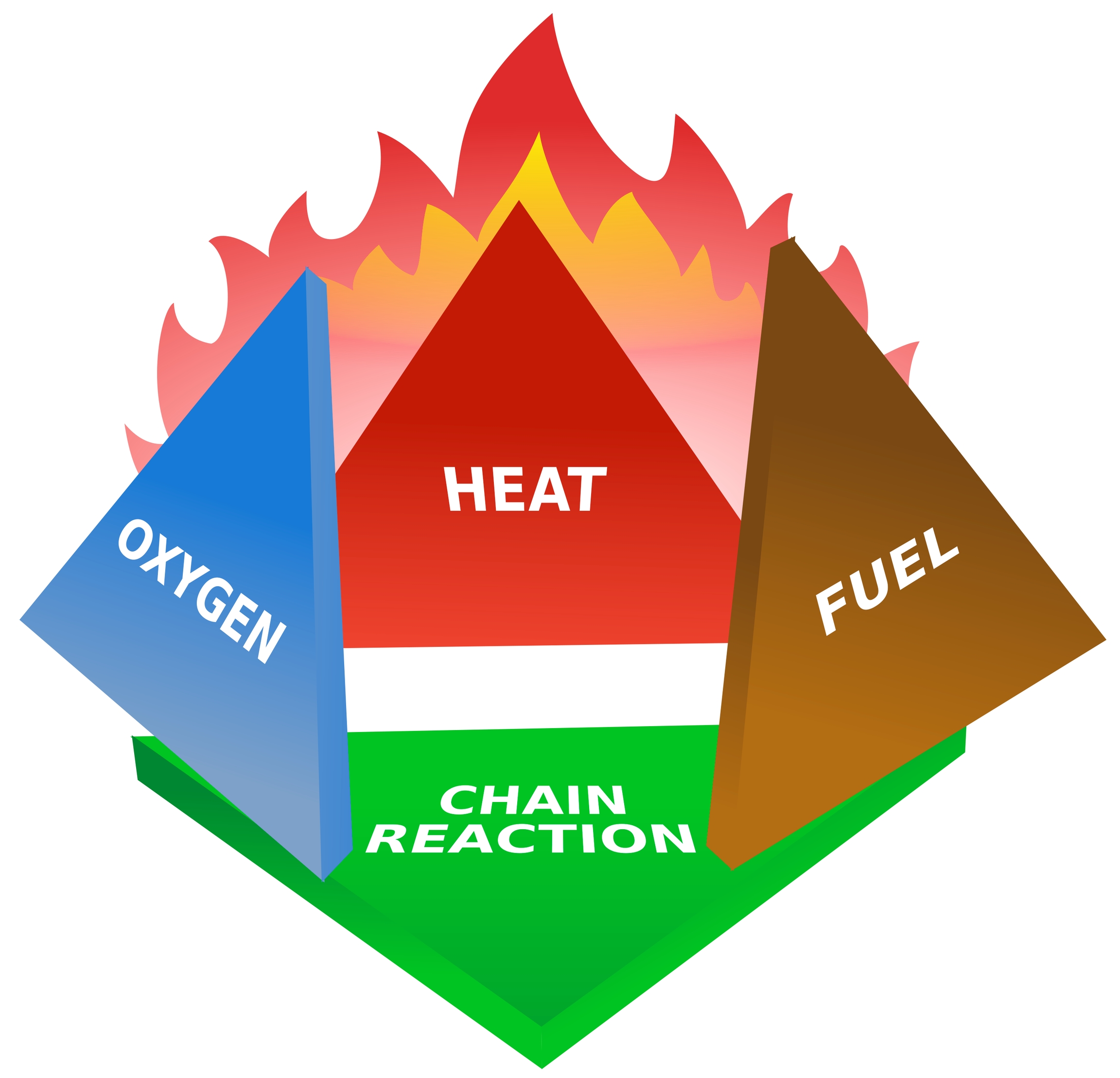

In scientific terms, Fire is the release of energy through an exothermic reaction from rapid oxidation of fuel. Often a catalyst for creation, destruction, and/or creative destruction, Elemental Fire maps on to the electro-magnetically dominated, ionized, and reactive State of Matter: Plasma

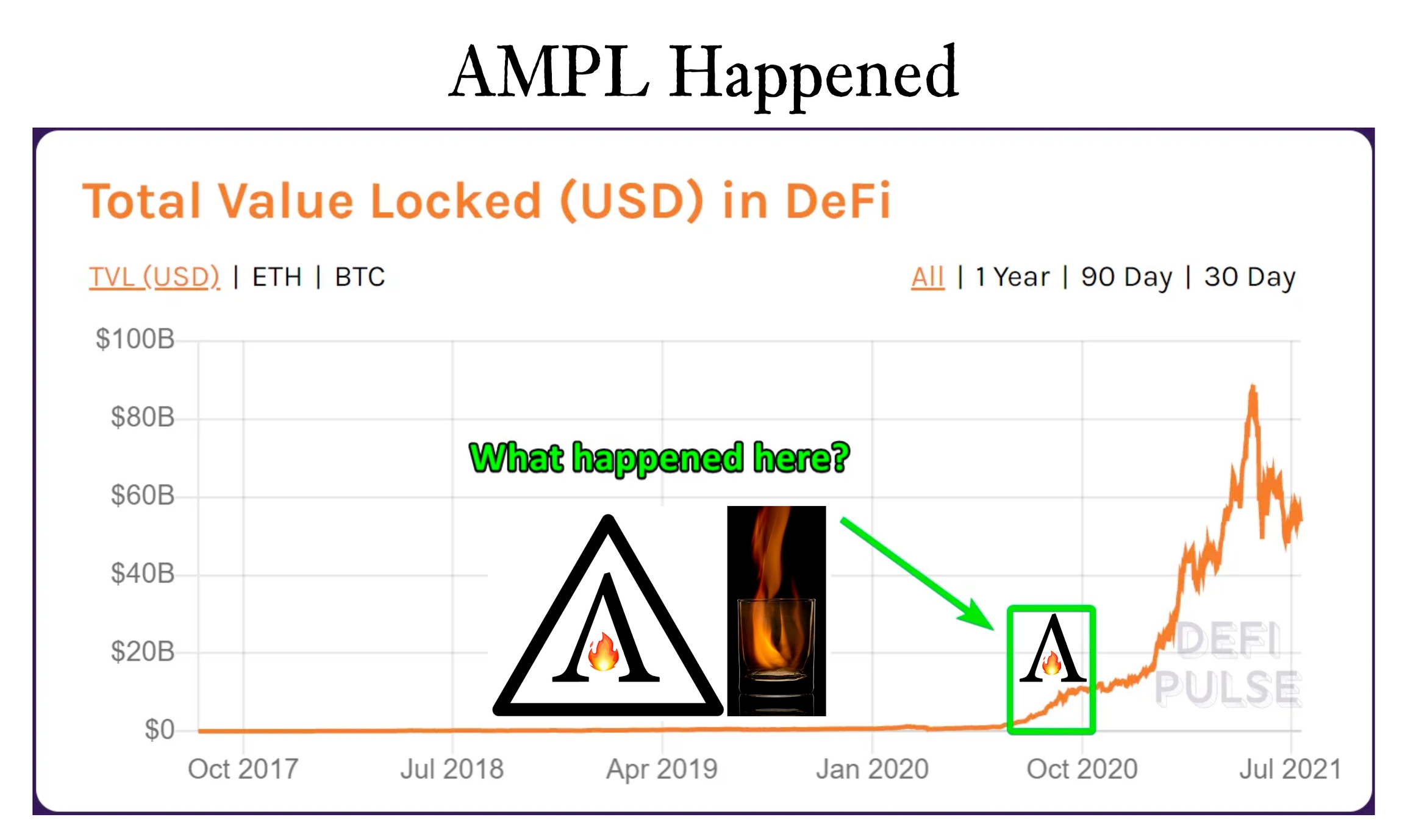

As outlined in this documentation of events, an explosive exothermic like reaction appears to have catalyzed the boom of DeFi Summer 2020.

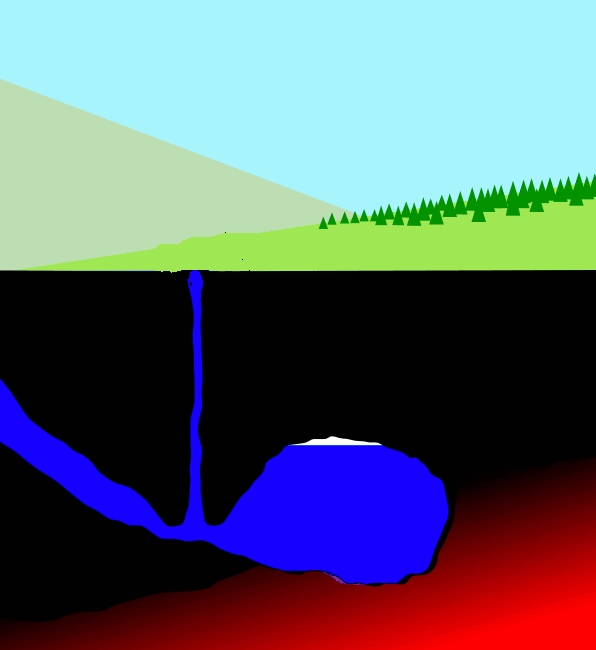

When the Ampleforth Geysers went live, a tremendous amount of energy (in the form of Liquidity vis-a-vis Digital Elemental Water - ETH) was released in a very short timeframe.

Fire can destroy everything in its path, clearing the Earth for new life to grow. This also applies to Water; too little leads to droughts, and too much can flood - as evidenced by the unfortunate flooding of Yellowstone National Park, which ironically is home to 100s of Geysers (though they were not the direct cause of flooding).

Interestingly, this event unfolded within weeks of the catastrophic UST/LUNA cascading liquidations. How might this inform our understanding of Active Inference, and Ethereum: A Model of the World?

Ampleforth Geysers V1 were seeded with the Digital Asset AMPL, which was rewarded to providers of ETH/AMPL liquidity on Uniswap. Analogous to the manner in which Fire and Earth polymerize to form Magma that fuels a Geyser's hydrothermal explosion, AMPL was responsible for the explosive liquidity that kickstarted DeFi Summer 2020.

AMPL is Digital Elemental Fire 🔥

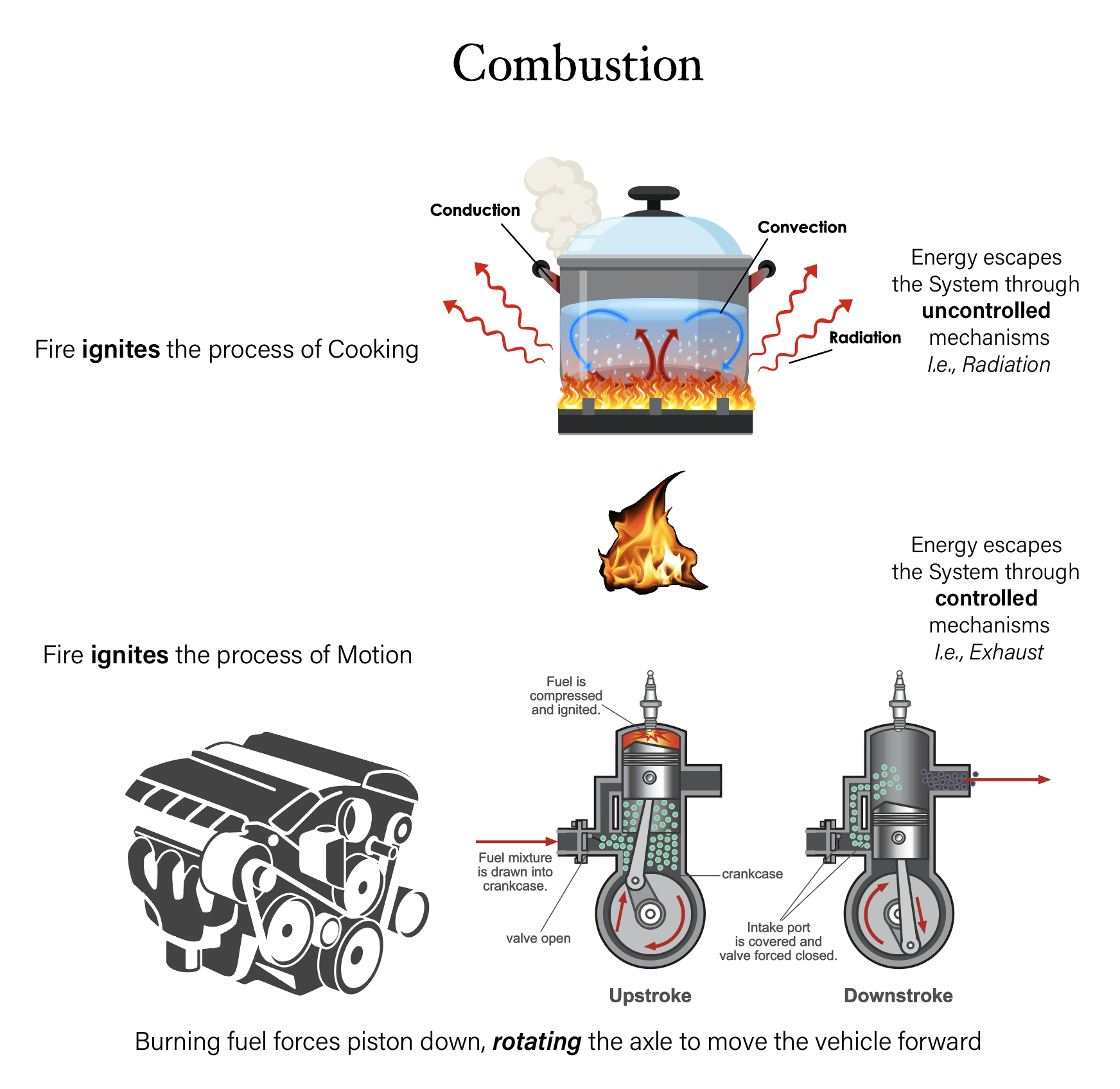

Fortunately over the past 3 years, this Fire has been tamed as we've come to learn more about its behaviors. In comparison to fueling inefficient exothermic processes that result in energy loss (e.g., cooking), 🔥 has been harnessed to derive utility & create value in a systematic fashion.

More on this to come in the Roaring 20s timeline. See Engine Metaphor for context:

🚗pageEngine Metaphor AMPL-SPOTWhat exactly is AMPL?

In the context of Digital Assets, the answer to this question makes sense through a framework of Financial Primitives.

Financial Primitives

For something to serve the role of Money, it generally has to satisfy three criteria:

Store of Value

Medium of Exchange

Unit of Account

Store of Value - BTC

The Bitcoin Network pioneered Peer-to-Peer Value Exchange. Widely adopted as Digital Gold and a hedge against Monetary Debasement (Quantitative Easing; money printer brrrrr meme), BTC the Digital Asset has become a de facto Store of Value in the world of web3 & Distributed Ledger Technology. This is evidenced by it's dominance in bear markets when market participants migrate their Capital to BTC for storage. The Digital Elemental Earth like properties of solidity, rigidity, stability, and generalized ossification lend themselves naturally to a Store of Value.

Medium of Exchange - ETH

Building upon Bitcoin's breakthrough, the Ethereum Network innovated Peer-to-Peer Value Exchange coupled with Peer-to-Peer Execution of Smart Contracts. A reservoir of Liquidity in Decentralized Finance, the Digital Asset ETH exhibits characteristics that resemble a primary Medium of Exchange. Whether it's stablecoins like USDT, USDC, DAI, or native tokens from other blockchains ported onto Ethereum like WBTC (wrapped BTC) or any ERC-20 token on Ethereum - ETH is the Medium for its Exchange. Without Digital Elemental Water, there is no simultaneously adaptive & cohesive structure to the ecosystem; without ETH, there is no liquid Medium of Exchange.

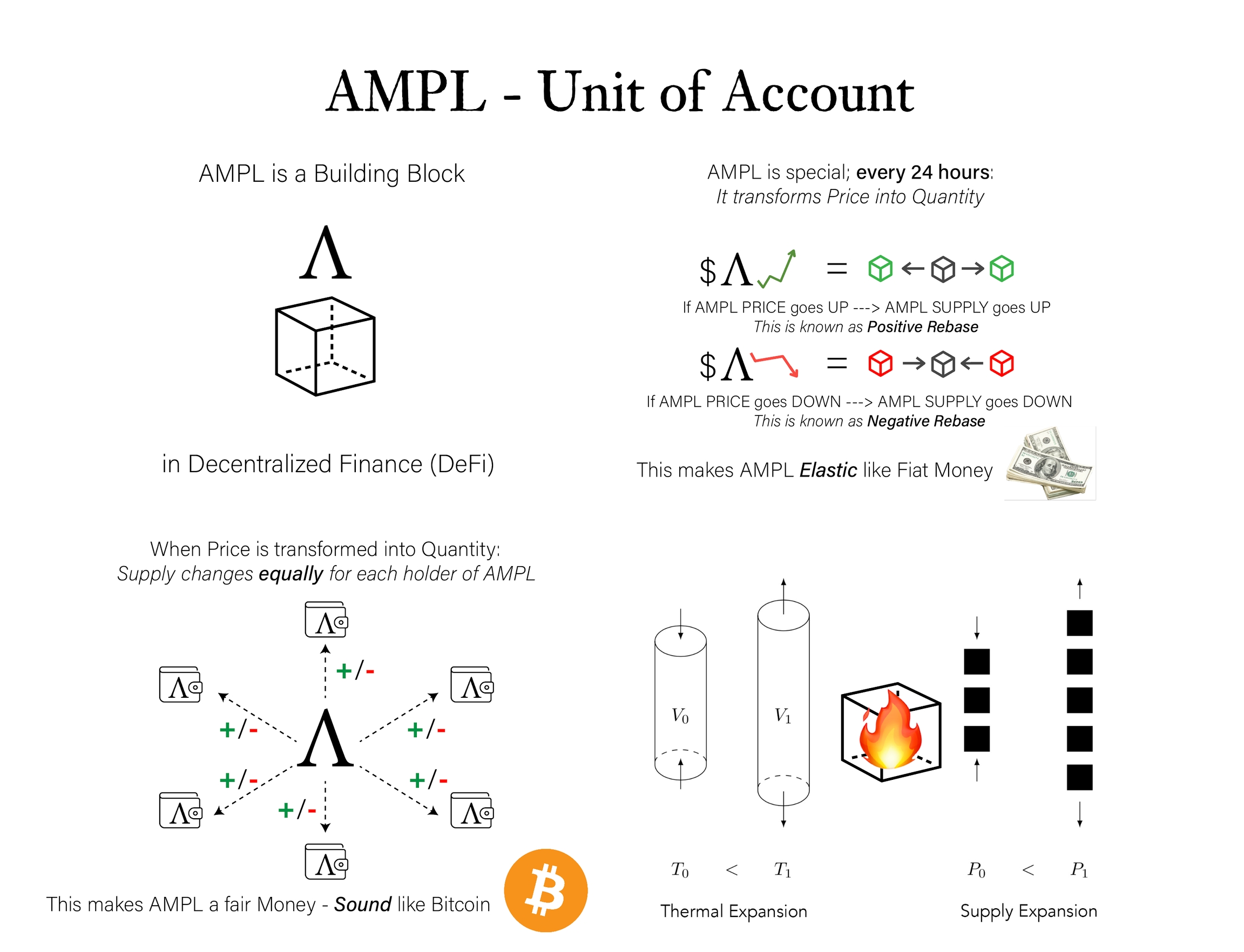

Unit of Account - AMPL

In contrast to Bitcoin and Ethereum, there is no Ampleforth Network. The Ampleforth Protocol is blockchain agnostic. Guided by Peer-to-Peer Consensus amongst market participants, the Digital Asset AMPL can find its home on any Distributed Ledger; e.g., at this time, AMPL is available on Avalanche, Binance, and Meter, while the deepest liquidity lies on Ethereum Mainnet.

Whereas the Digital Assets BTC and ETH respond to market forces by adjusting their Price, AMPL reacts by dynamically modulating its Quantity, or Supply.

By adjusting Supply, AMPL's Price remains stable over the long-term.

What is the Price of AMPL?

AMPL's price target tracks the Inflation-Adjusted price of the U.S. Dollar from 2019.

As a result of Monetary Debasement & Inflation, today (May 2023) this number has risen to $1.16.

The maintenance of long-term price stability is a desirable property for any instrument that can be used as a measure/standard of relative worth and deferred payment - i.e., a Unit of Account. Because Price volatility is smoothed out over the long term, AMPL can be used as a Unit of Account to denominate financial contracts that are resilient against liquidation events.

Indeed, this is how Inflation-Resistant Peer-to-Peer Cash (Decentralized Flatcoin - a kind of Stablecoin that remains "flat" in the face of Inflation) has been designed using Mechanized Vaults.

With widespread adoption of decentralized flatcoin SPOT, the synthetic commodity money AMPL is poised to become DeFi's Unit of Account

Crucially, Fire requires a channel to travel through. This Energy cannot exert its transformative effects in a vacuum.

🔥 cannot react with 🌎 or 🌊 without 🌪️

Last updated