🌊Water

2nd Element

Can be heard, touched, seen, and tasted; but it is odorless

If BTC is like Digital Elemental Earth, then the native token on the Ethereum Decentralized Network - Digital Asset ETH (pronounced "eeth" like "teeth," minus the t) - is representative of Digital Elemental Water. ETH is liquid with other Digital Assets on Ethereum.

Elementally, Water is associated with cohesion, liquidity, fluidity, and adaptability.

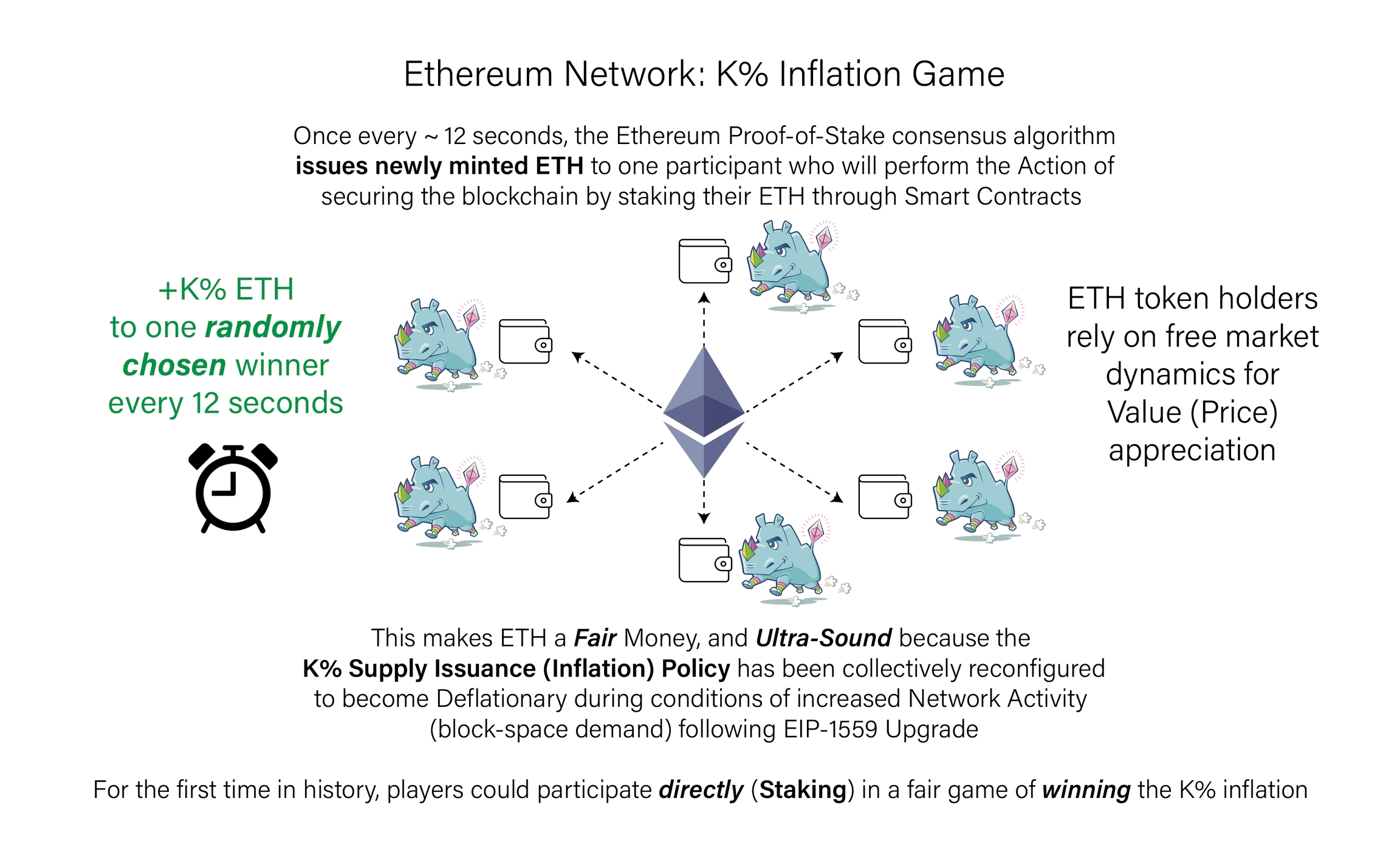

In contrast to Bitcoin, Ethereum is like a living organism that is continuously evolving and upgrading through Ethereum Improvement Proposals (EIPs), proposed and ratified by the community of network participants. This cardinal dynamism is facilitated by Smart Contracts.

Smart Contracts

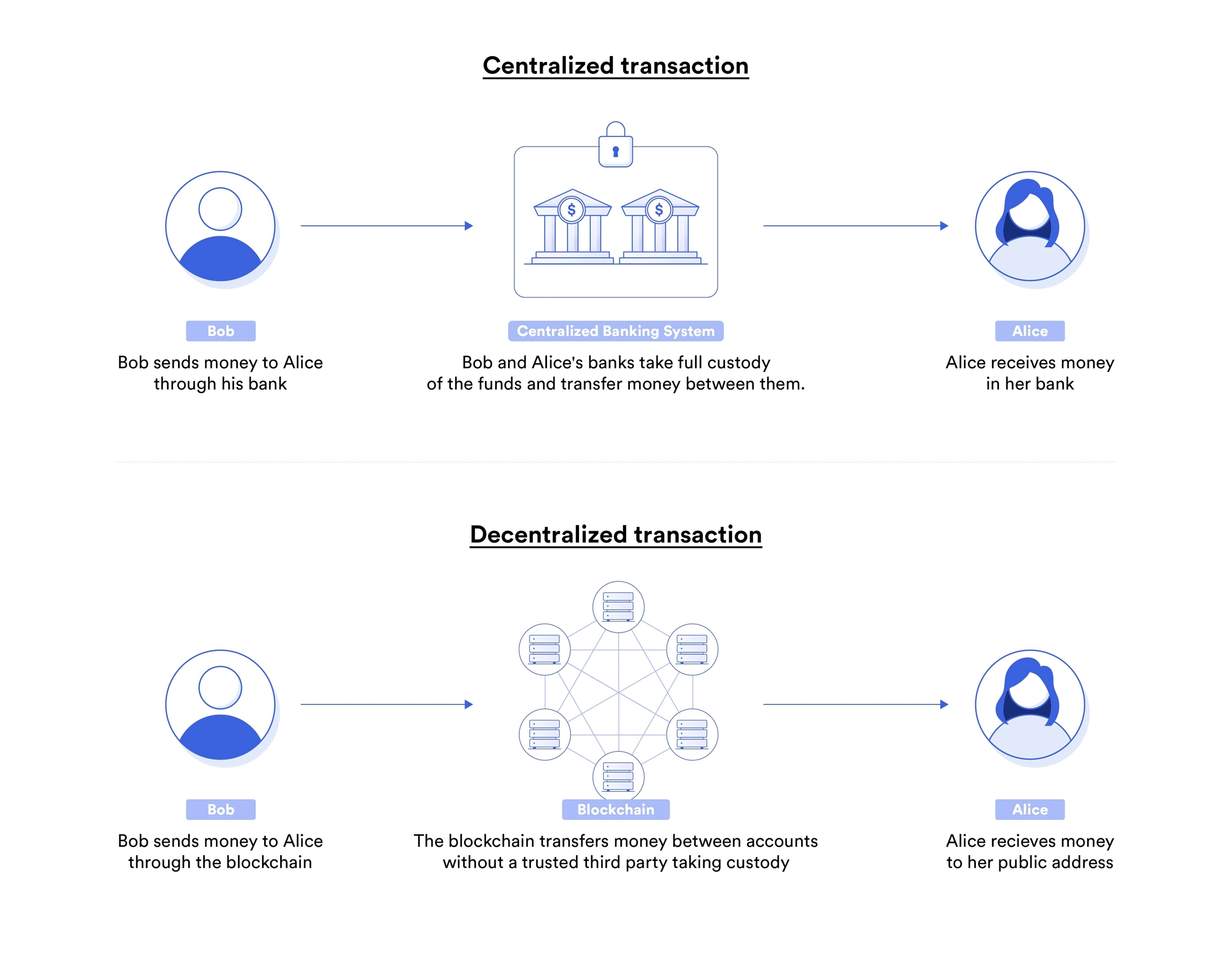

The innovation of Peer-to-Peer Value Exchange without intermediaries is Bitcoin's value proposition, which makes BTC a financial primitive. The Ethereum Network builds upon this breakthrough:

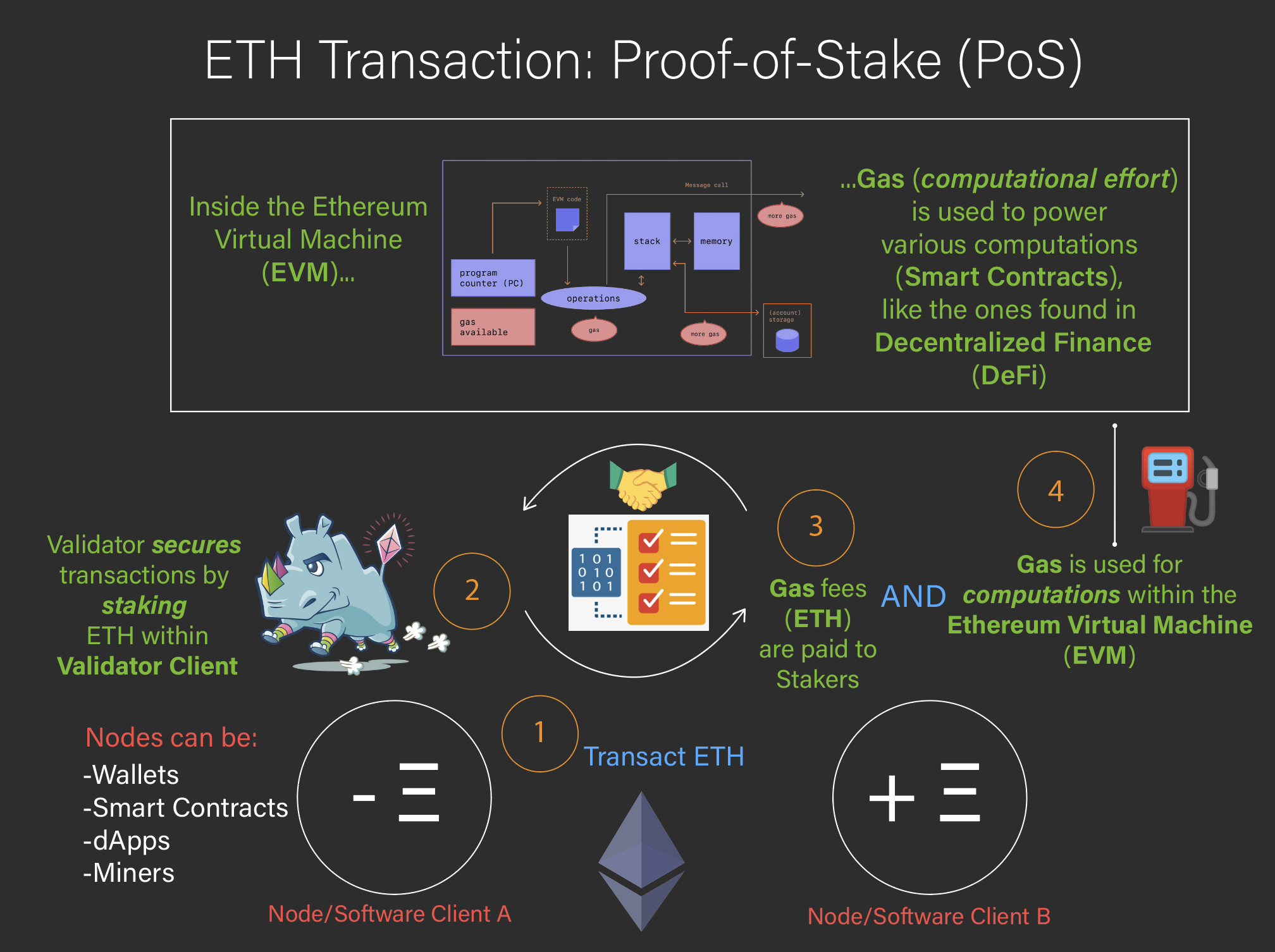

Peer-to-Peer Value Exchange is paired with Peer-to-Peer Execution of Computational Work within the Ethereum Virtual Machine (EVM).

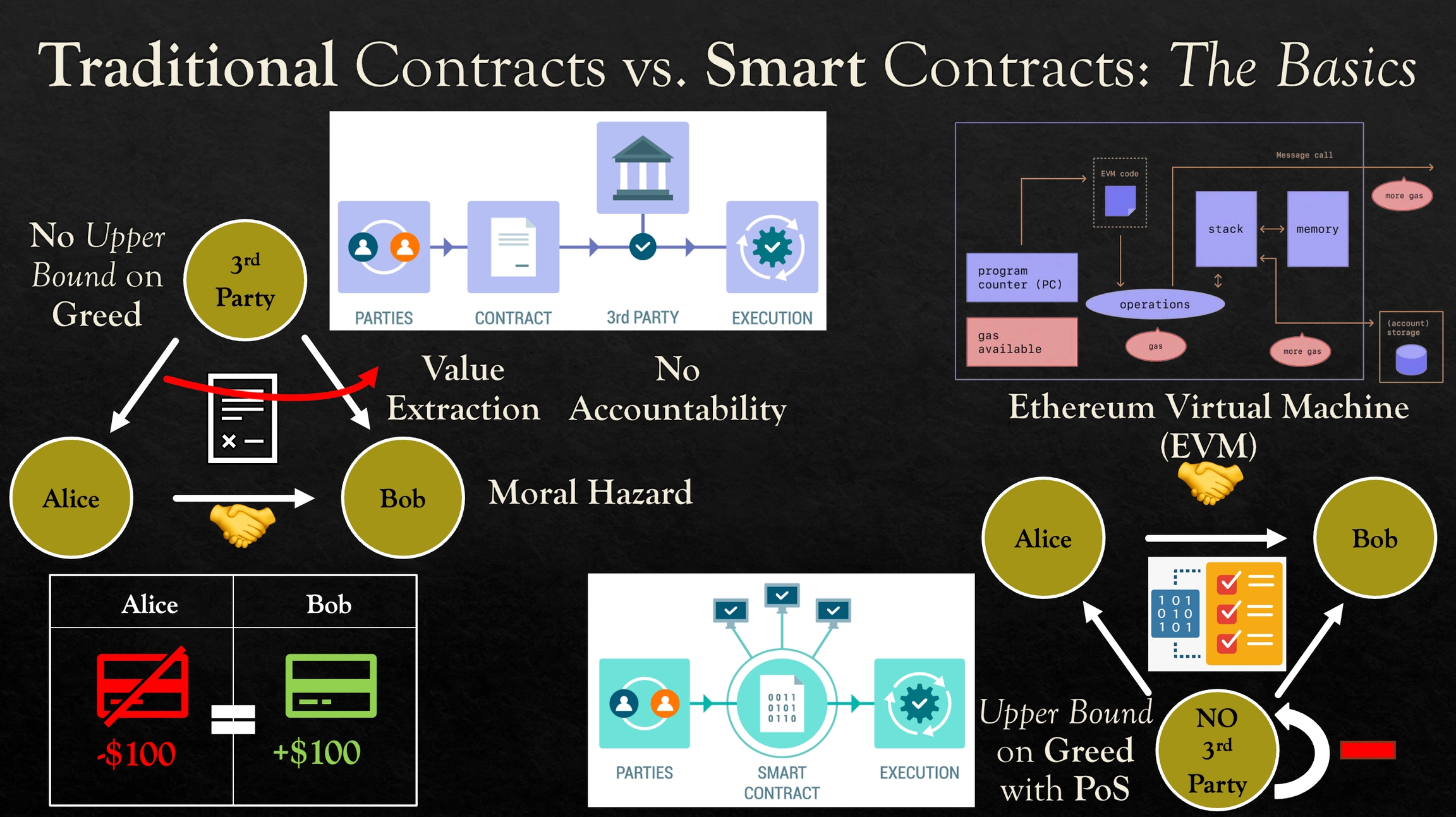

In other words, Agreements 🤝 pertaining to lending, borrowing, counter-party risk, etc. that were historically carried out by human intermediaries, are instead enforced automatically by 🤖 computer code. These Agreements are known as Smart Contracts.

Fundamentally, Smart Contracts are less vulnerable to Moral Hazard.

In contrast to the Proof-of-Work (PoW) Consensus Algorithm that secures the Bitcoin Network, Smart Contracts enable the Ethereum Network to attain Consensus via Proof-of-Stake (PoS).

Different Rules --> Different Game

The Digital Asset ETH is a financial primitive because it is necessary for Smart Contract execution

Liquidity Pools

As Elemental Earth relates to the Solid State of Matter, Elemental Water maps on to the Liquid State of Matter.

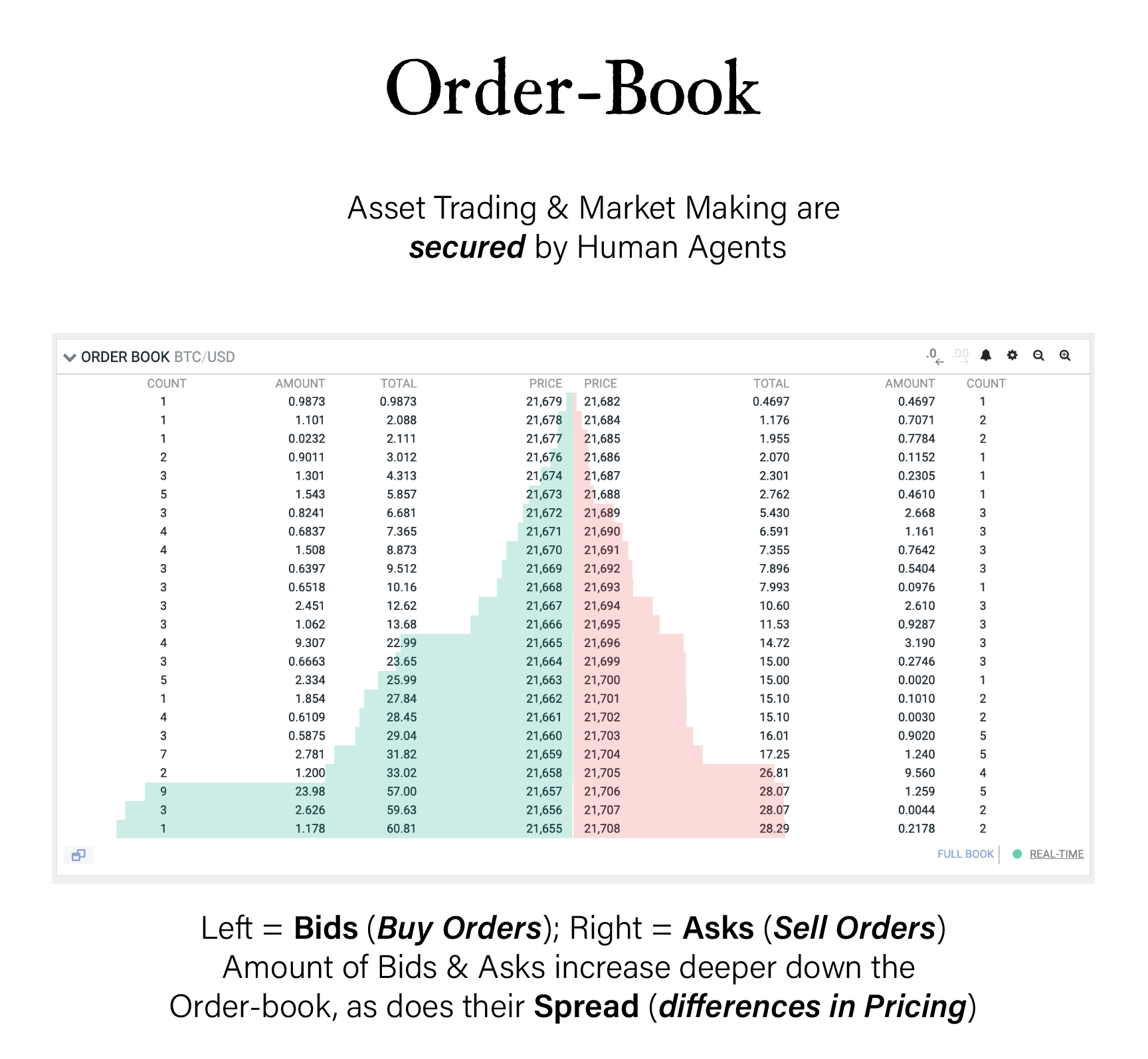

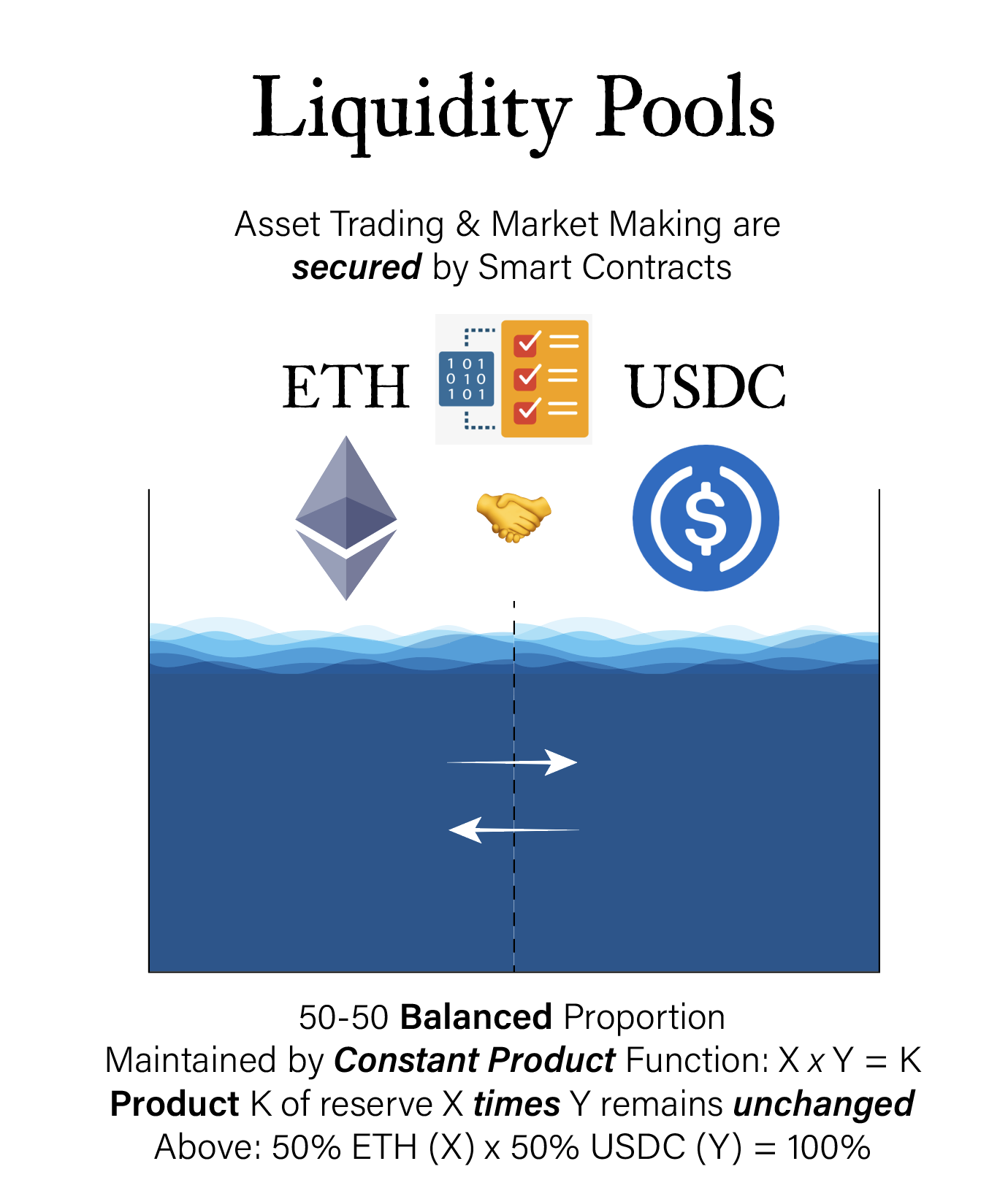

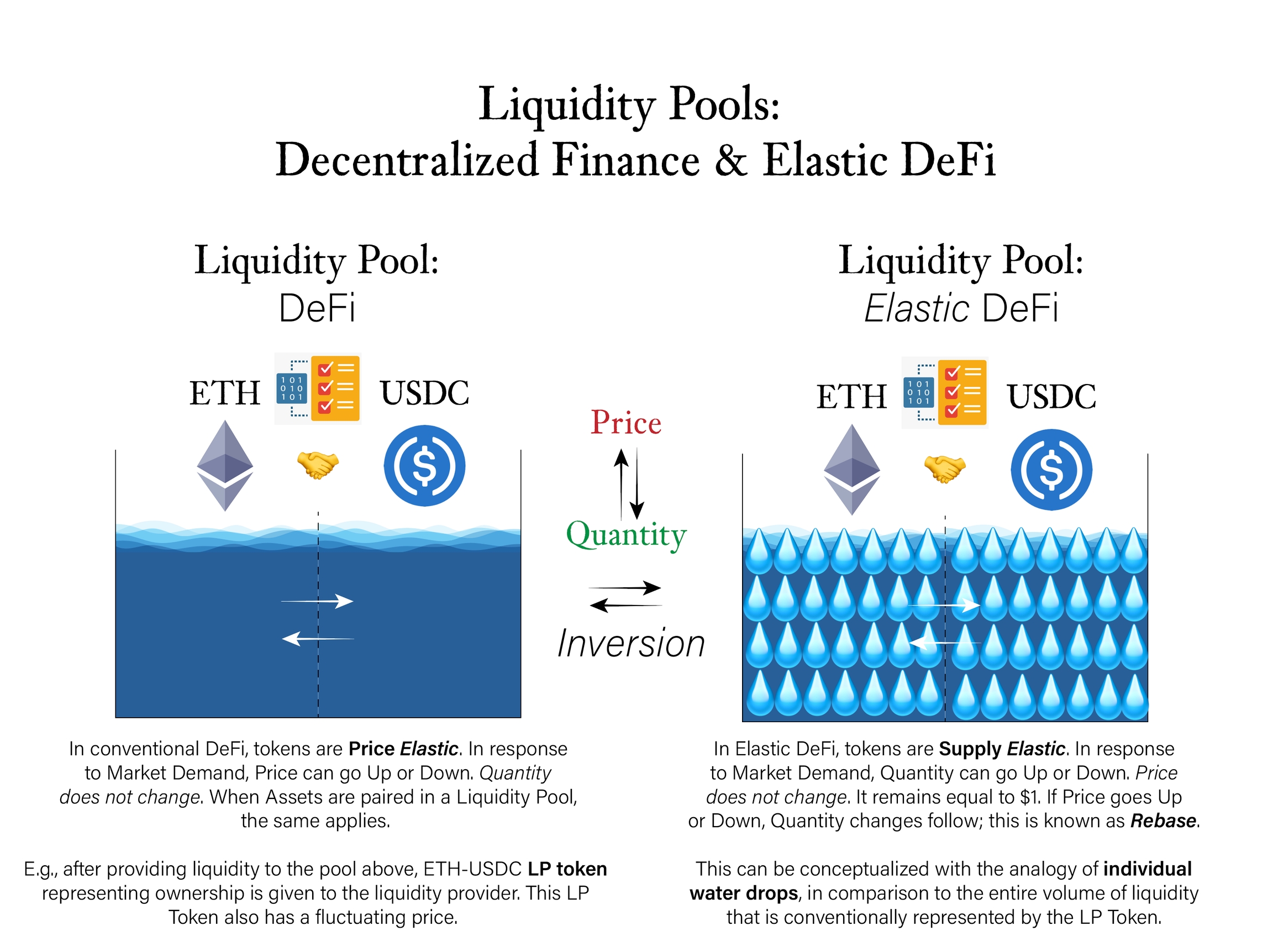

In Liquidity Pools, the Markets are made by Smart Contracts; hence, these are known as Automated Market Markers (AMMs). In Traditional Finance, trading is facilitated by Market Makers through Order-Book style pairing of assets on Centralized Exchanges (CEXes).

AMMs operate on Decentralized Exchanges (DEXes) and they provide the open market with abundant liquidity. On Ethereum, Digital Assets other than ETH are classified as ERC-20 tokens. Digital Assets are paired with each other in Liquidity Pools. When ETH is paired with ERC-20 tokens, these tokens acquire market liquidity - that is, they can be bought & sold for a relatively stable price. Relatively stable because deeper the Liquidity --> smaller the change in the asset's price as it is bought or sold.

To understand this phenomenon, a liquidity pool can be conceptualized as a beaker filled with water that is separated by a semi-permeable membrane. Below, the ratio of Digital Assets ETH and USDC (ERC-20 token) are equally balanced in a 50-50 proportion.

Naturally, -ΔX (ETH) will result in +ΔY (USDC) and vice-versa. Due to the laws of Supply & Demand, the changes in quantity also change the price.

Therefore, assets in a liquidity pool are said to be relatively volatile with each other. This incentivizes Arbitrage Trading and dynamic market participation. You can explore more about this at Uniswap - one of the first AMM DEXes.

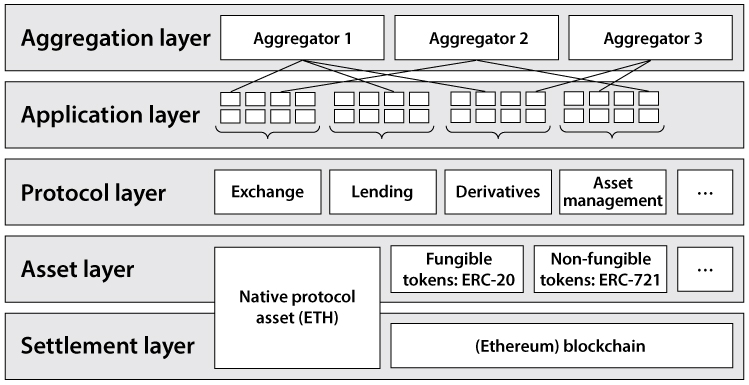

DEXes are the foundation of Decentralized Finance (DeFi).

Put water into a teapot, it becomes the teapot. Put water into a cup, it becomes the cup.

Put Digital Elemental Water into a Liquidity Pool...and it becomes Liquid

Incentives --> Outcomes

Why might market participants opt to deposit their Capital onto an AMM/DEX?

When end users like your or I deposit Money onto a Centralized Exchange, Market Makers use these funds to facilitate trading; and they are incentivized to do so, because in return they are rewarded with market maker & taker fees. In contrast, the market is made automatically on DEXes. Depending on the Smart Contract rules of the DEX (e.g., Uniswap, Sushiswap), the trading fees accrue to Liquidity Providers (LPs; end users) and/or the tokens used for governing the platform.

Decentralized Finance

Why are DEXes foundational?

DEXes powered by AMMs provide open access to Liquid Capital --> Liquidity begets Liquidity, and Capital is deployed towards Futures Contracts and trading of derivative financial instruments --> Positive Expectations of future pricing attracts more Capital into DEXes --> Risk-On behavior, speculation, and optimism for innovative ideas promotes an ecosystem to flourish.

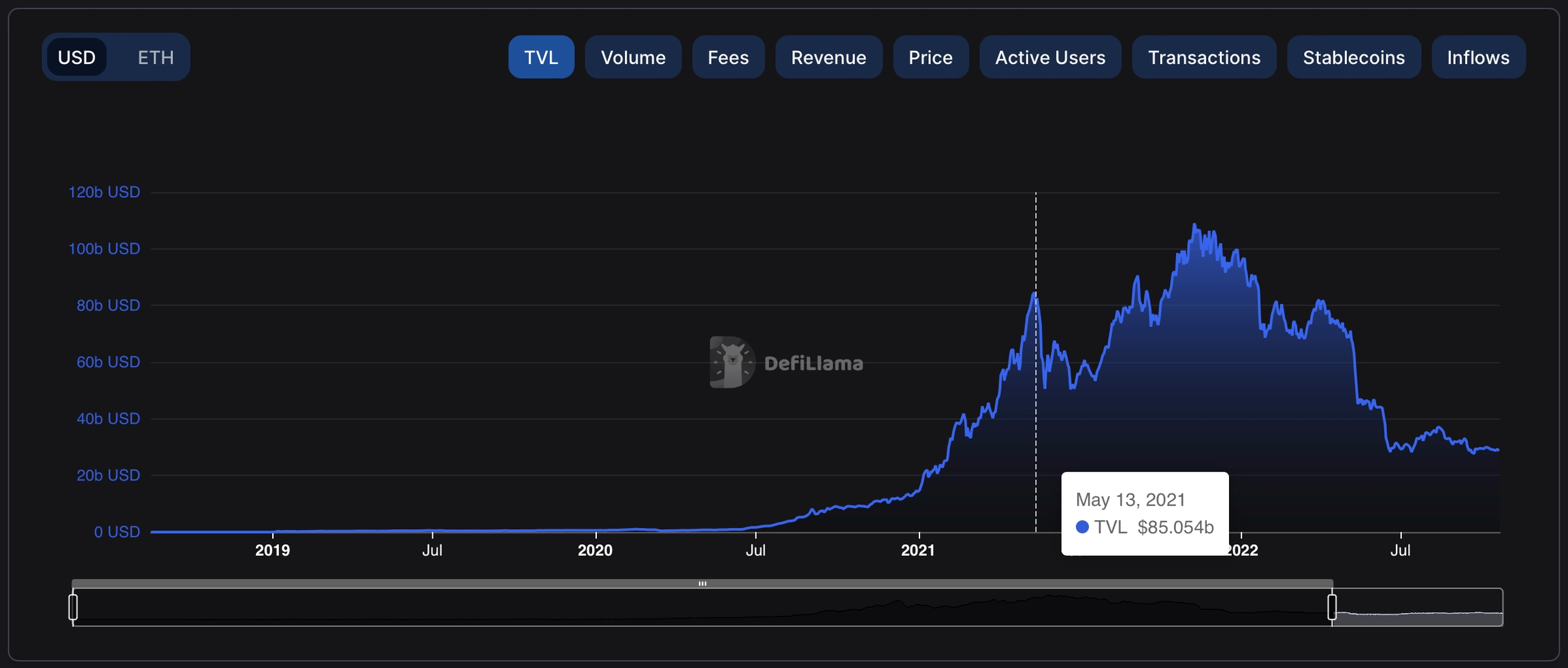

Like tidal ebbs & flows, such events are cyclical. The initial boom began in Q2-Q3 2020 "DeFi Summer," catalyzed by a number of interactions including but not limited to Compound & Uniswap governance token airdrops, the advent of "yield farming," and the first AMPL expansion.

From DeFi Summer through May 2021, Total Value Locked reached $85B on Ethereum.

Like Bitcoin, various narratives have evolved to frame our collective understanding of ETH. ETH exhibits properties that resemble digital versions of:

Liquid (State of Matter)

Gas (like gasoline; used for computational execution of smart contracts)

Oil (Commodity with Utility Value)

Bond (Financial Instrument with reliable yield, which is earned via Staking)

In comparison to Creditors who own Equity in a company (or Network, in this case), Bondholders are Debtors (lenders) so they are made whole and repaid first

Like Bitcoin, once again we have many Narratives. However, with Smart Contracts we unlock new Degrees of Freedom. Consequently, as does the Peer-to-Peer Consensus around Narratives.

Elastic Decentralized Finance

So, we unlock Collective Imagination at Unprecedented Scale. Gazing beyond lofty platitudes, we can observe this phenomenon unfold in real time and leverage its pragmatic applications:

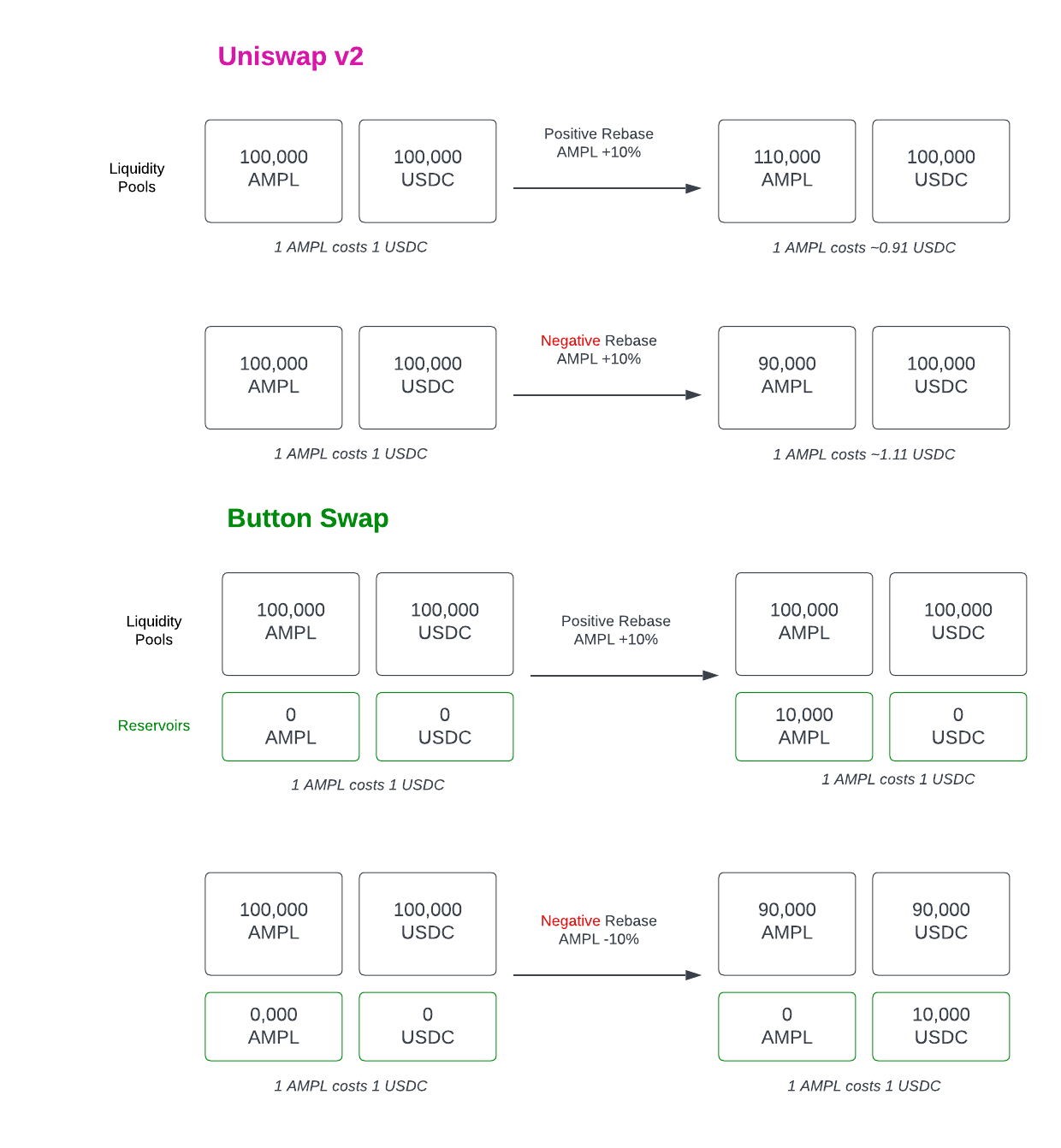

Conventional liquidity pools broadcast how much volume of "Water" is available for trading. Instead, what if liquidity pools revealed how many individual drops of "Water" were contained within?

As mentioned above, liquidity pool assets are relatively volatile with each other. Relative Volatility is another term for Impermanent Loss: the cost incurred by Liquidity Providers, which is captured by Arbitrage traders who profit by pocketing the margin that comes from balancing liquidity pools. Naturally, stablecoin liquidity providers experience the smallest amount of Impermanent Loss; the loss is theoretically impermanent so long as the assets return to their original prices. However, in practice, the loss ends up being permanent as Digital Assets like BTC & ETH are "up only." Well, mostly.

That being said, innovative projects like Buttonwood are building a Reservoir that plans to mitigate Impermanent Loss almost entirely. This is another significant advantage of Supply Elastic Assets.

Last updated